Bookkeeping isn’t just a chore; it’s the lifeblood of any business, big or small. It’s all about keeping tabs on every dime that comes and goes, jotting it down accurately, and making sure the numbers add up. Let’s chat about why bookkeeping rocks and how it can be your business’s BFF, helping you call the shots, keep the cash flowing, and stay on Uncle Sam’s good side.

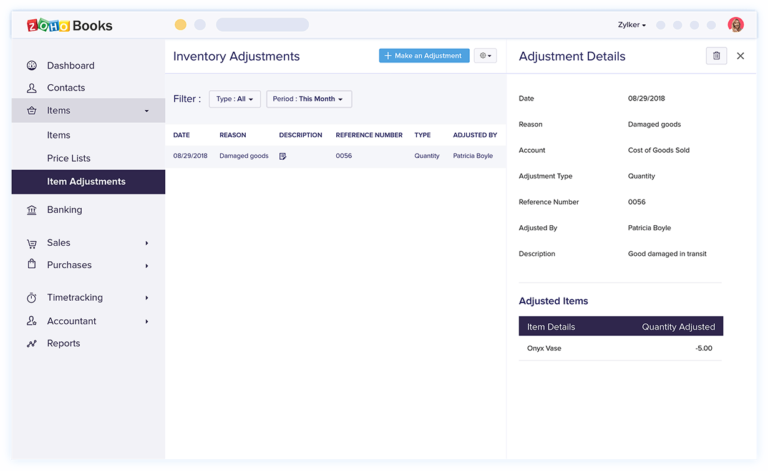

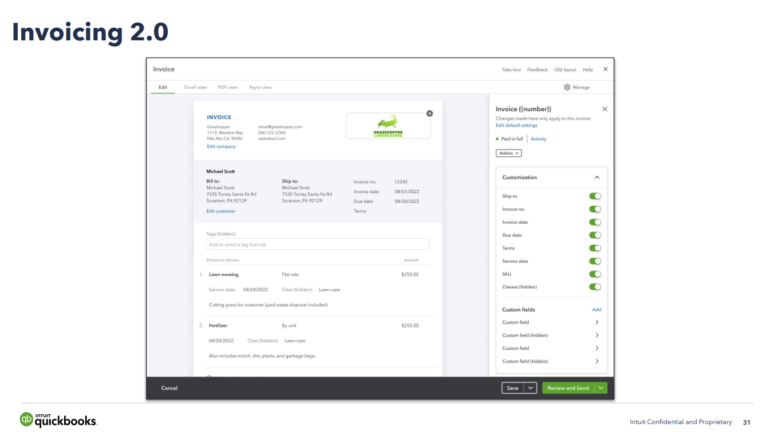

At its heart, bookkeeping is all about keeping a tight grip on a business’s financial comings and goings. That means jotting down every sale, expense, asset, and debt faithfully. It’s like playing financial detective, logging everything in ledgers or fancy accounting software, and making sure your bank statements match up with your records.

According to the Small Business Administration (SBA), “meticulous record-keeping is crucial for small business success. Not only does it help you manage your cash flow, but it’s also essential for tax compliance and making informed business decisions.”

Why bother with all this record-keeping? Well, for starters, it’s your ticket to managing your moolah like a pro. By tracking where your cash is coming from and where it’s going, you can spot money-saving opportunities and plug any cash leaks. Plus, it ensures your financial records don’t raise any red flags when compared to your bank statements.

But wait, there’s more! Good bookkeeping also gives you a crystal-clear view of your financial health. Armed with accurate numbers, you can spot trends, track your progress, and make savvy decisions about where to invest or expand. And hey, having a handle on your finances makes it way easier to predict cash flow and plan for the future.

And let’s not forget about taxes! You’ve gotta keep Uncle Sam happy by keeping meticulous records of your income and expenses. That means dotting your i’s and crossing your t’s to comply with tax laws and score every deduction you’re entitled to.

According to the Internal Revenue Service (IRS), “accurate and complete financial records not only help you file your tax returns accurately but also support items reported on your tax returns.”

Keeping your financial records in tip-top shape means staying on top of things. That means logging every sale, every purchase, and every expense faithfully. And of course, regularly churning out those snazzy financial reports to keep your finger on the pulse of your business’s financial health.

In a nutshell, bookkeeping is the unsung hero of financial management. It gives you the lowdown you need to make smart choices, keep the cash flowing, and steer clear of any tax-related hiccups. And if you’re feeling overwhelmed, don’t sweat it—there are plenty of bean-counting pros out there ready to lend a hand and keep your financial ship sailing smooth.