Mastering QuickBooks Payroll: 5 Essential Tips from Sheldon Bookkeeping

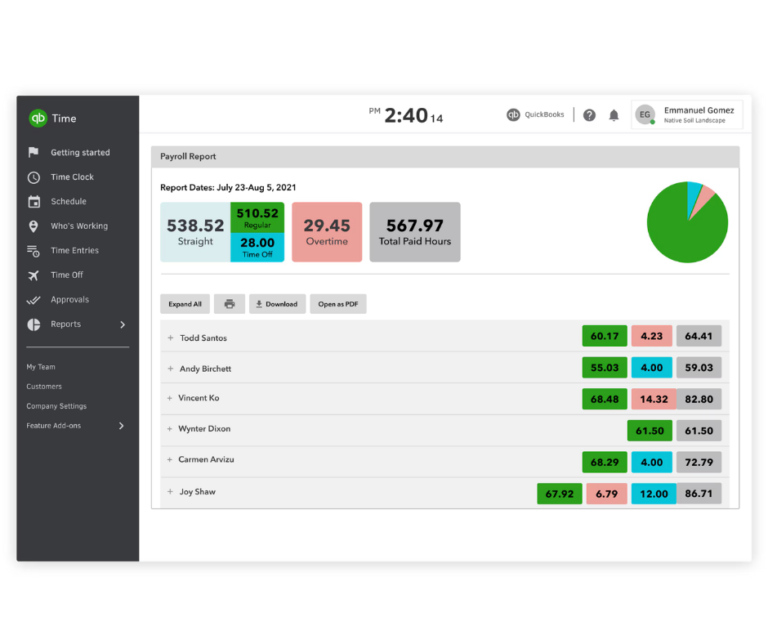

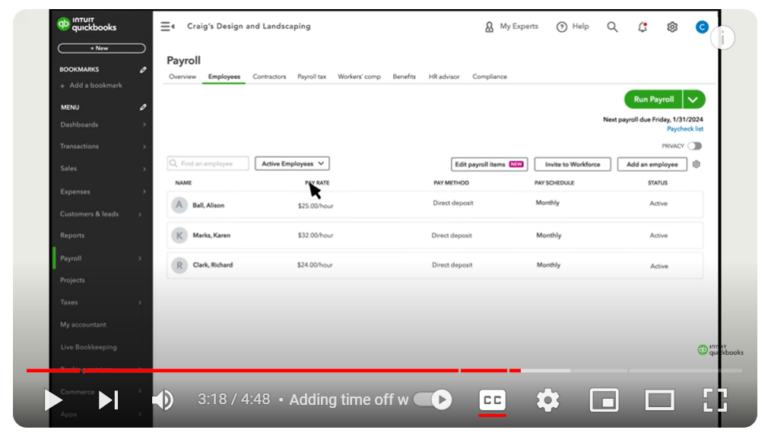

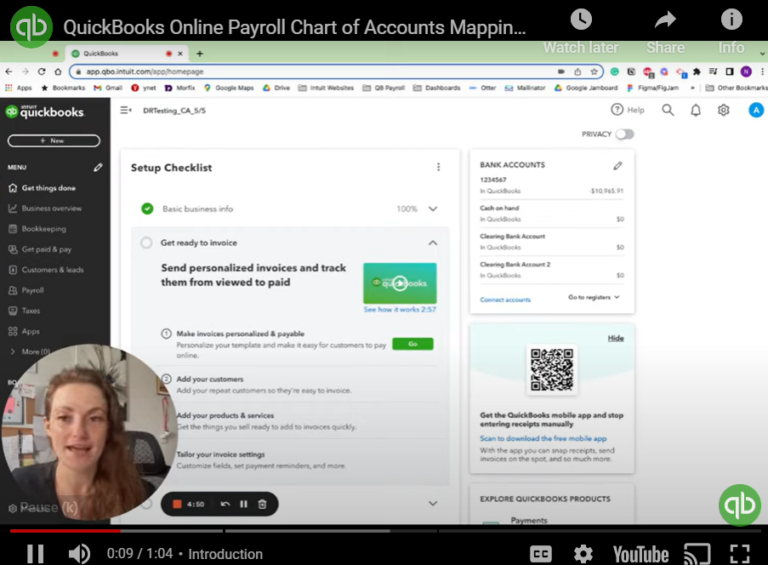

Payroll management is the heartbeat of any business, ensuring that employees are compensated accurately and on time. In today’s fast-paced world, leveraging efficient tools like QuickBooks Payroll can make all the difference. As a leading provider of modern accounting solutions, Sheldon Bookkeeping is here to share five indispensable tips for mastering QuickBooks Payroll: 1. Stay…