Don’t Worry if You Missed the Tax Deadline

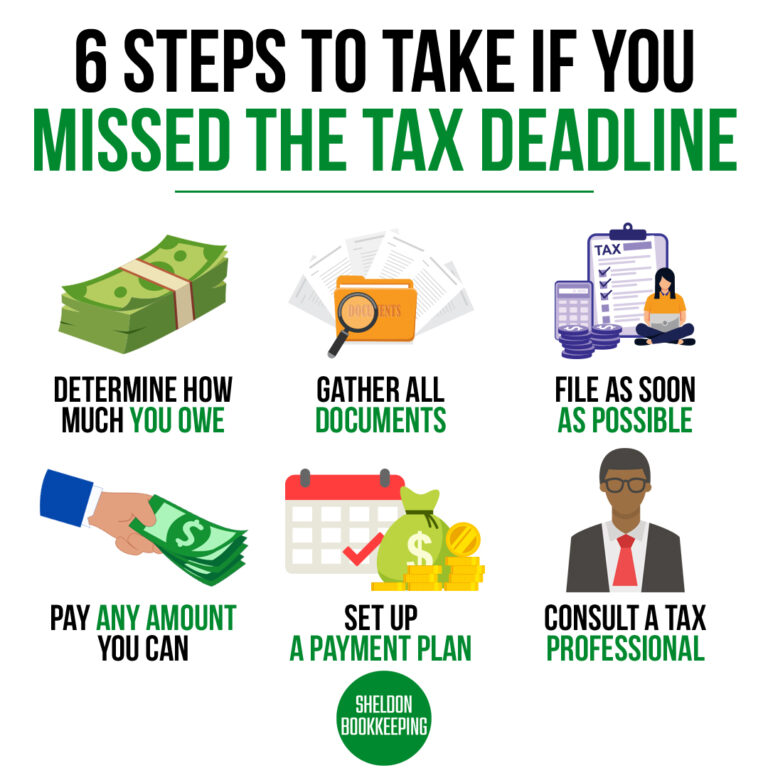

Facing a missed tax deadline can indeed induce stress, but there are constructive steps you can take to navigate this situation effectively. Let’s collaborate to reinstate your tax responsibilities and alleviate any concerns. Start by evaluating your tax status, pinpointing any overlooked filings or pending payments. Assemble all pertinent financial records such as income statements,…