QuickBooks Payroll Pricing Increase Announced

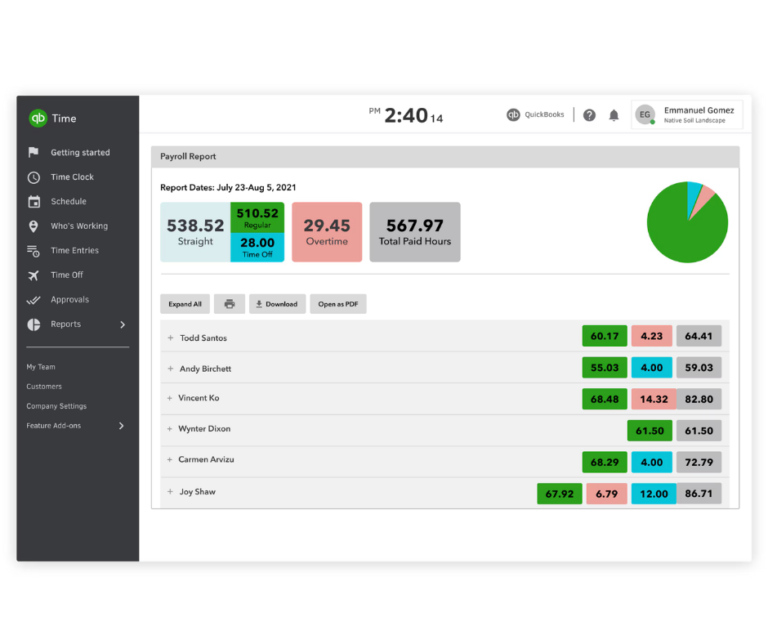

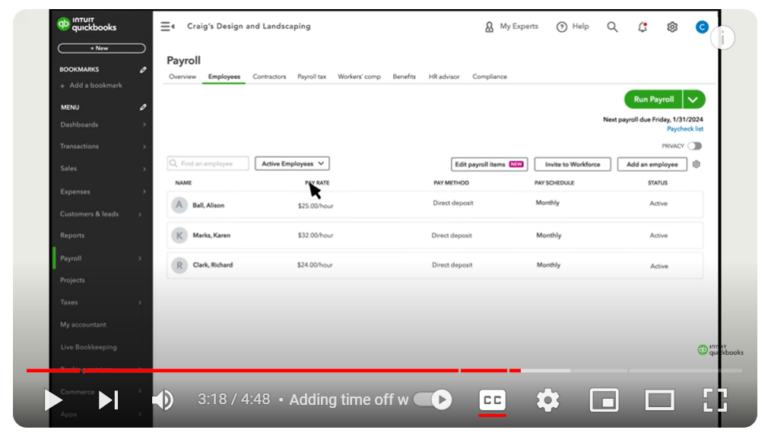

The price of all three subscriptions levels of QuickBooks Online Payroll will increase. Starting in August, the new prcing will take effect. QuickBooks Payroll Pricing QuickBooks Online Core, Premium, and Elite product and related per employee price changes will occur on or after the dates indicated below the table. QuickBooks Online Payroll Payroll Core…