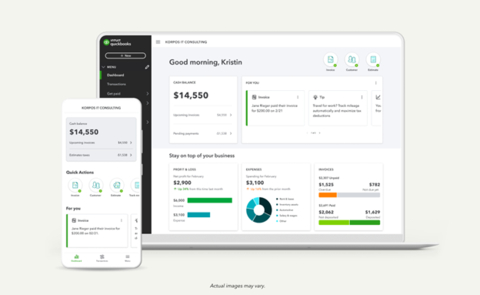

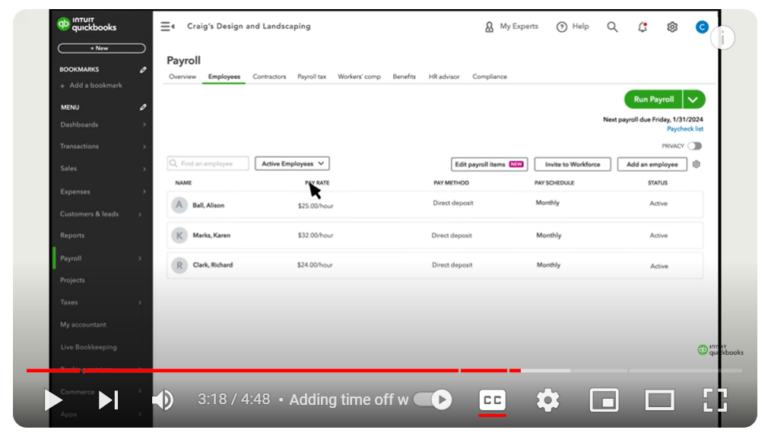

User Roles Being Redefined in QuickBooks Online

Starting in May 2024, Intuit is set to roll out updates to user roles within QuickBooks Online, affecting subscribers of QBO Essentials, Plus, and Advanced. These changes, targeting ‘standard roles’ in these subscriptions, will introduce new role assignments and access settings. Users can anticipate notifications regarding these updates by mid-March. The adjustments are summarized as…