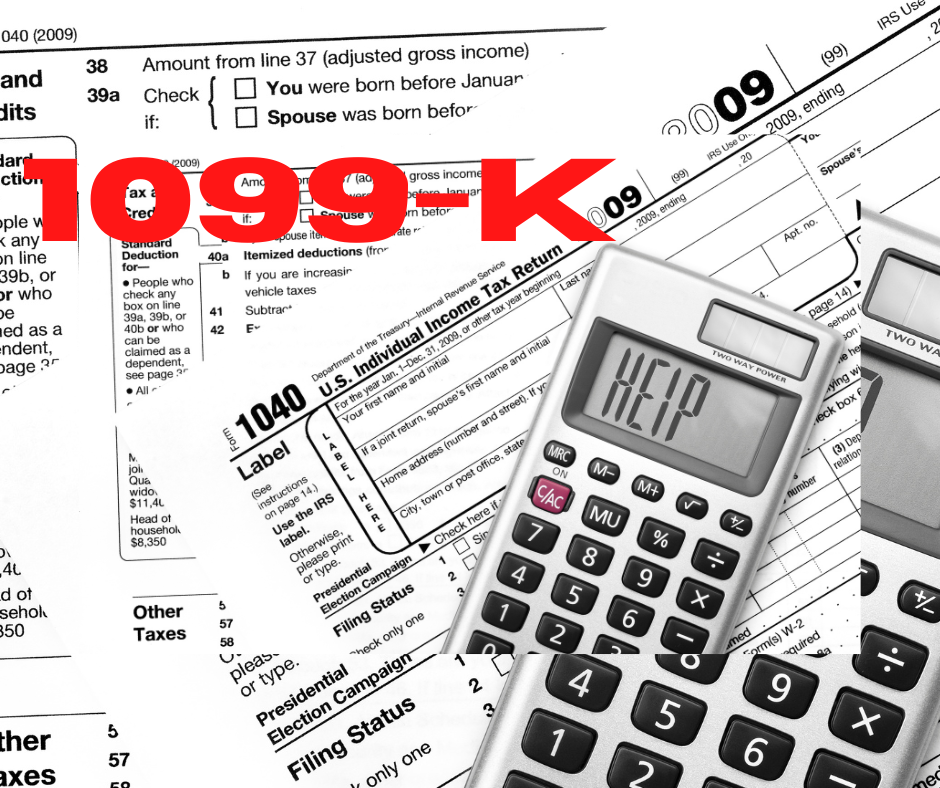

Here Comes the 1099-K

The payments from online platforms such as Venmo, PayPal, Etsy, Uber and Facebook Marketplace are going to be reported to the IRS via a 1099-K. This change, brought on by a change in The American Rescue Plan Act of 2021, lowered the reporting threshold to $600.

Business transactions of all kinds will be reported, including things like AirBNB payments for those vacation rentals.

The IRS warns to be sure to include those payments and reminds everyone that income from part-time or full-time employment or gigs, or sales for goods and services, are taxable.

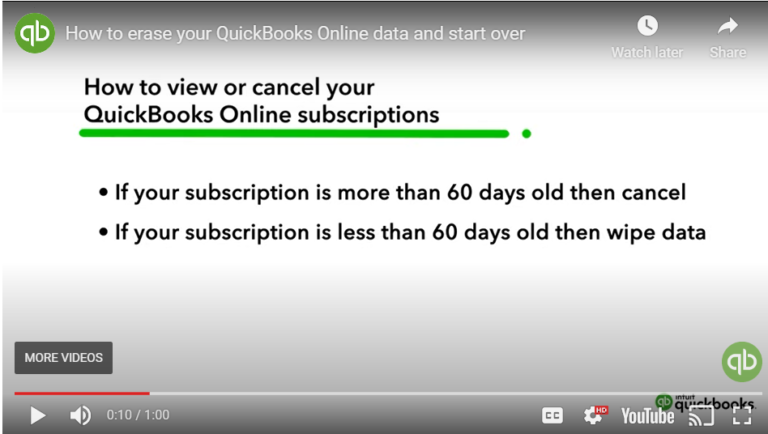

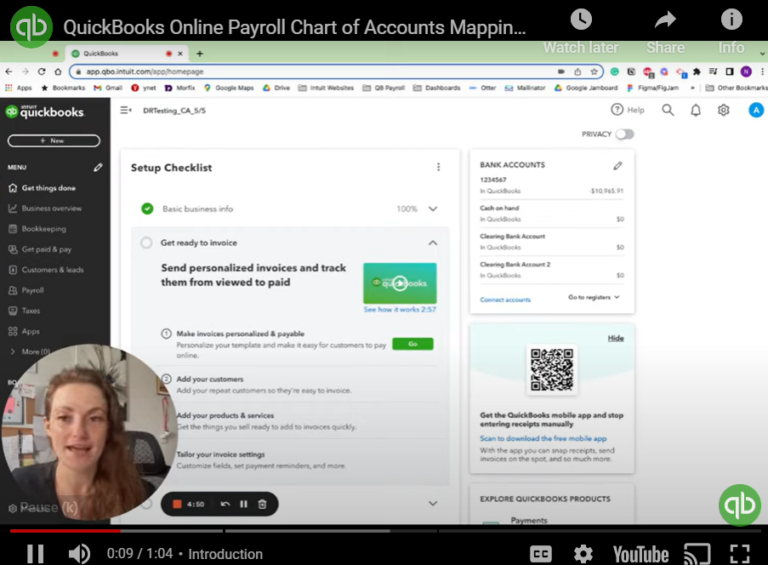

Make sure your books are ready for tax filing by making certain those electronic payments are properly recorded and categorized.

CNBC’s website has published a story about the 1099-K reporting and included some tips on how to lower your taxes. You can read that article by clicking here.