Some real estate agents wait until it’s time to get their annual taxes filed, and then they scurry about trying to assemble a year’s worth of receipts, bills, and check stubs into some form of business financial records.

Others plan ahead for tax day, by maintaining accurate, up-to-date financial records.

Getting into business is easy enough, but staying in business and maximizing your income is the true goal you even considered taking the leap into operating your own enterprise. As an agent, operating as an independent business person, you are required to maintain business financial records by government authorities. Often, you must file tax returns more than once a year, and there are additional reporting requirements not that can affect an agent, such as your use of independent contractors. If, for example, you hire a photographer to photograph properties you are marketing, you must file 1099 forms if the amount you paid is $600 or more.

Of course, you can better control expenses and certainly determine which types of transactions earn you the most money, if you are maintaining your business books.

Which accounting software is right for you?

A Google search for “real estate accounting software” will show you multiple solutions. You will see familiar companies, like Quickbooks. There are also alternative accounting software solutions that agents can use. And it is better to use something, rather than nothing.

Freshbooks, Xero, RealtyZam, Wave, and Zoho are some of the alternative accounting platforms for real estate agents and brokers. A few are free, but most are available on a monthly subscription plan.

You can certainly spend time going through all the alternatives to Quickbooks. But I am going to recommend that you start with QuickBooks Online, and the best version for a new or single-agent business to use is Simple Start.

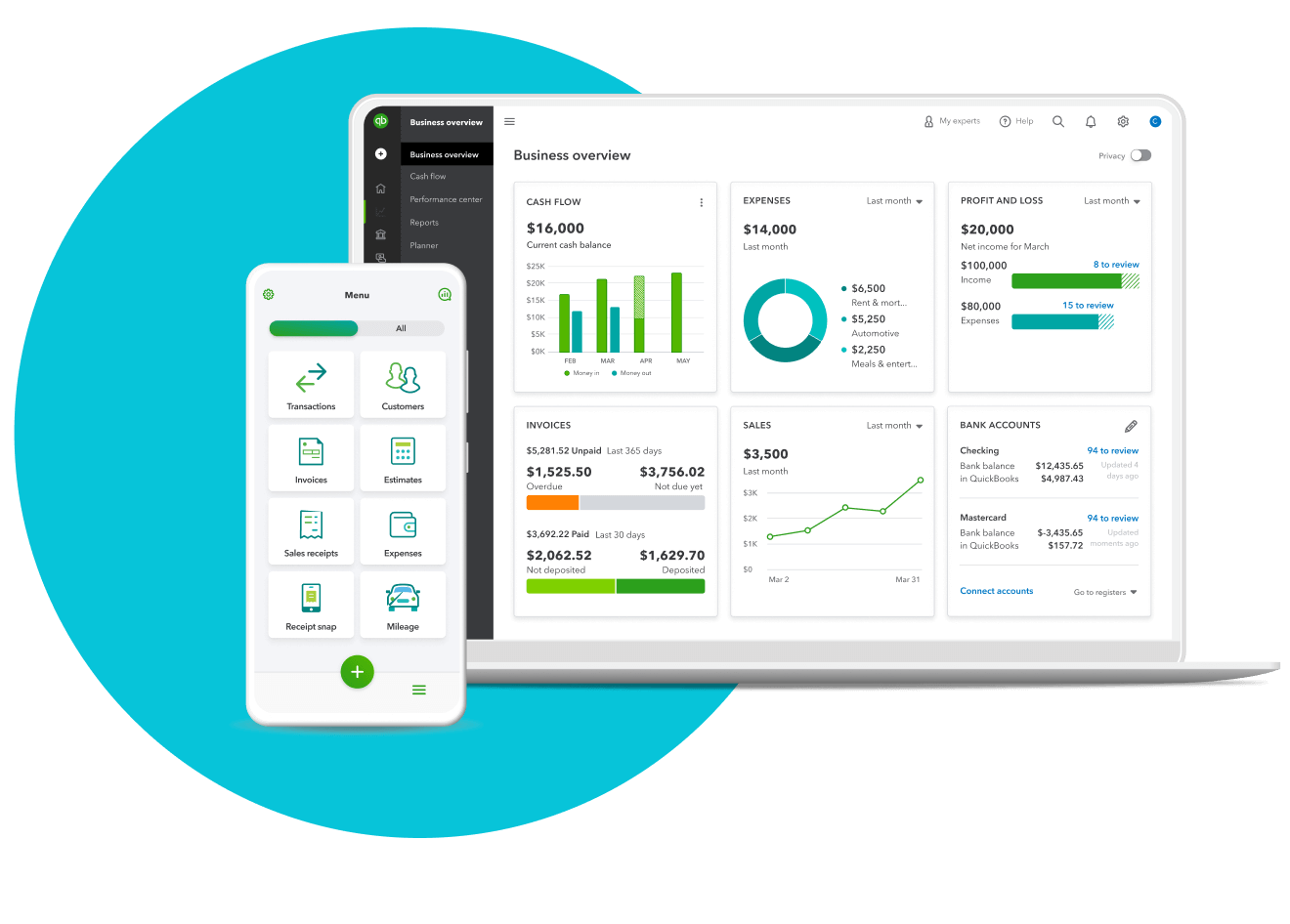

As you weigh your options, consider that QuickBooks Online includes the use of a mileage tracker app, as well as the capability to capture receipts and have it automatically entered into your QuickBooks.

When thinking about the costs, consider that Freshbooks will cost $65 a month to integrate a mileage tracker, as you need their highest tier plan.

You will find support is more likely available to QuickBooks users. While there are people successfully using Xero and Freshbooks, and others, you are likely to find more people familiar with QuickBooks products.

If your real estate business grows, and you start expanding into a team or acquiring income-producing properties, you will be able to easily expand QuickBooks Online and even change your subscription level to get more features. As you get familiar with QuickBooks Online, you may want more features.

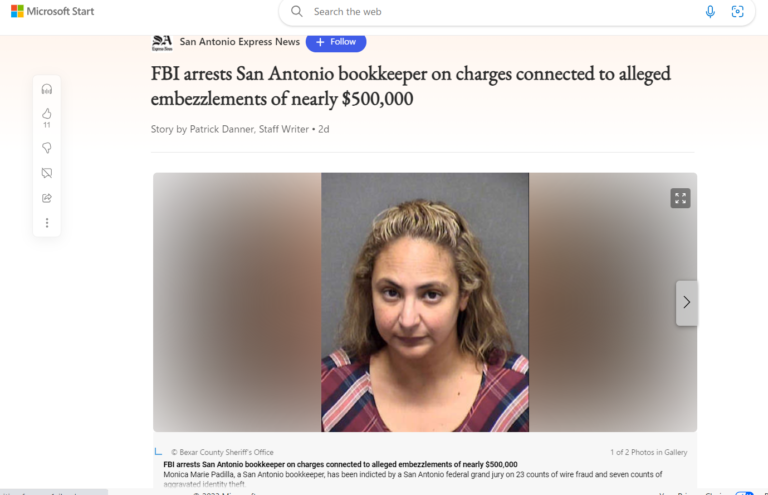

Some agents decide that they really do not want to bother maintaining their financial books, and will turn the bookkeeping chores over to a bookkeeper. It certainly gives the agent more time to work with clients and within their own business. Outsourcing bookkeeping and accounting is always an option with QuickBooks Online, and you can still maintain total control over your accounts and finances.

QuickBooks Online can integrate with bank and credit card accounts, and many other software packages. For example, it integrates with DocuSign. It can also integrate with specialized rental programs like Airbnb.

You can access your QuickBooks Online anywhere you have an internet connection, and on any device, from a phone to a pad, to a laptop or desktop.

There are a lot of reasons to like QuickBooks Online. For a working real estate agent, it is highly expandable and offers lots of expandability, no matter how the business might change.

This is the first of several blog articles about real estate business account for real estate agents. George Sheldon is a Certified QuickBooks ProAdvisor and is not an employee of Intuit or QuickBooks. He is the owner of Sheldon Bookkeeping.