Every business has its own way of being in business. Regarding bookkeeping, there has to be a way to reflect those differences. That is where the Chart of Accounts comes in, and why it is so important to get it set up correctly.

Keep in mind that there are four types of accounts that make up your balance sheet.

They are:

The Chart of Accounts (COA) is how transactions are categorized.

Special Note: Most of what I say here applies to smaller businesses. That means from 1 to 10 people in size. As a business grows, the Chart of Accounts may need to be expanded.

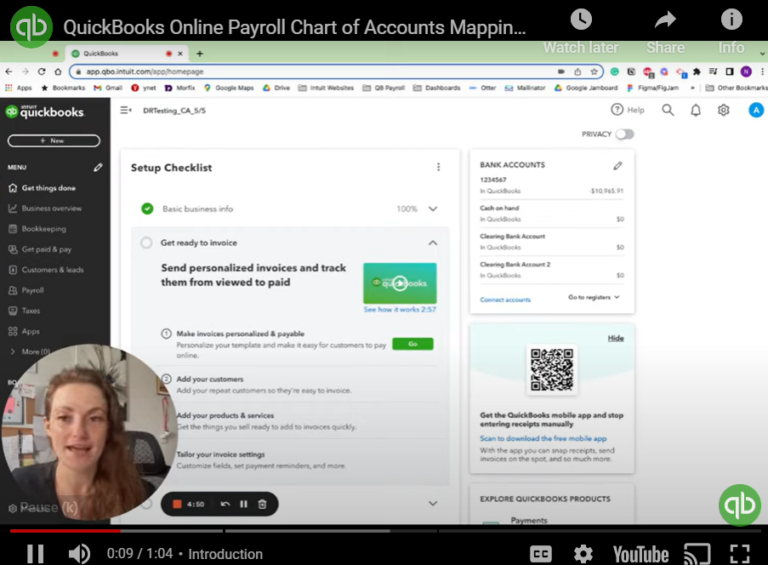

Getting the Charts of Accounts Setup in QuickBooks

- Each account in the chart of accounts is typically assigned a name and a unique number, This makes it easier to identify the account. Typically the account numbers are five or more digits in length, with each digit representing a division of the company, the department, the type of account, etc. QuickBooks will use the number and display them, but I recommend that my clients turn off the display (in other words, hide the account numbers). They are still there, but it is less confusing with not being displayed.

- It is always best to keep it simple. When starting the books, think more generally when setting up the Chart of Accounts. For example, consider the Utility account. Many new to QuickBooks is likely to set up an account for Electricity. They then add a separate account for Phone, Water, Sewer, and others. Keeping it simple would mean placing all these monthly expenses under the Utility account. If you want to see what you paid for electricity, run the QuickBooks Transaction List by Date Report.

- Don’t use a General Chart of Accounts. While it might be a place to start, you will likely find it lacking in providing you with a complete and meaningful financial report.

- Use a Chart of Accounts specific to your industry. For example, a real estate professional is running a different type of business than a bakery, and an auto parts store is far different from a custom carpentry shop. Each of these types of entities should have different Charts of Accounts.

- Businesses with Payrolls (or Employees) will need a bit more in their Chart of Accounts than a single-person business.

- Be cautious when adding the account to the Chart of Accounts. A real problem can develop when you have two similar named accounts or even duplicate accounts. This will need to be solved, and there are several ways to fix this, but the best practice is to prevent it from happening.

- Another problem develops when the Chart of Accounts is too large. For smaller businesses, as described above, there is no reason to have a large, unwieldy Chart of Accounts. It is a sign your books need some updating.

- Never delete an account in your Chart of Accounts with transactions accounted for.

- Don’t ignore negative balances in your accounts. Something is wrong, and this is an indication that the account needs to be investigated. It could be an incorrect account type, or a transaction was recorded to the wrong account. It is also possible that the negative balance is correct, but it should be checked out.

- Use an industry-specific Chart of Accounts. An exterminator (service business) should have a Chart of Accounts customized to their business, and not use another service business, such as an excavator. The more customized, the less liked mistakes will occur in the accounts.

That’s our 10 Tips to help you with your Chart of Accounts. You can learn more about QuickBooks Chart if Accounts by visiting this page. If you have any questions or need more information, feel free to reach out to me via the Contact Page.