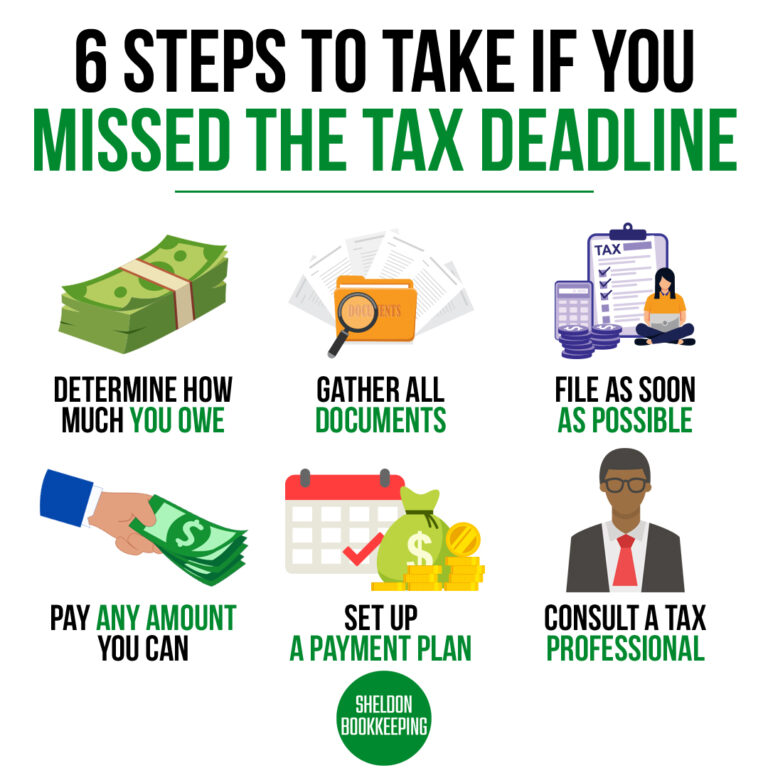

6 Point Strategy if You Missed the Tax Deadline

Adopt Sheldon Bookkeeping’s six-point strategy to tackle your overdue tax filings and embrace proactive record-keeping to stay ahead of the game! Keeping your books updated regularly not only guarantees precision but also prevents year-end pandemonium. Don’t allow disarrayed records to impede your progress. Let’s get you up to speed while you pledge to maintain consistent…