Properly Handling of 1099 Contractors for Small Businesses

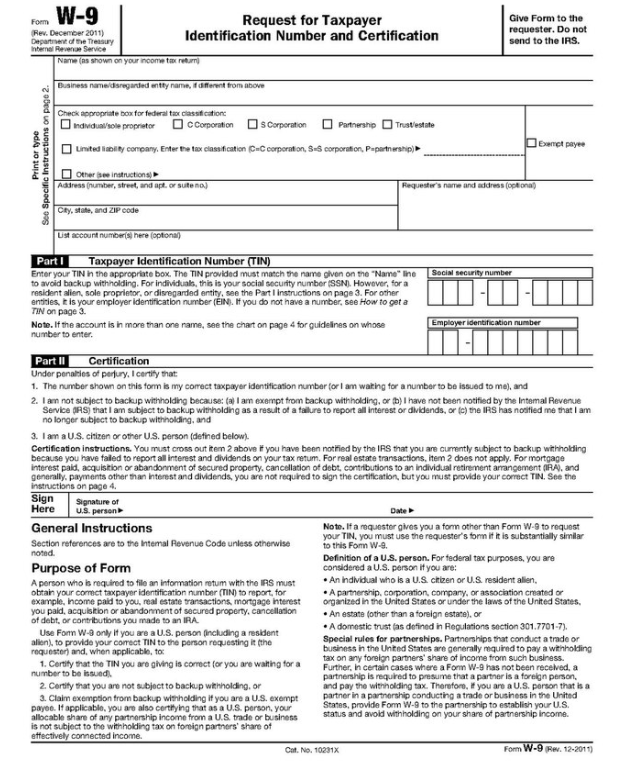

In the contemporary landscape of business operations, the utilization of independent contractors, commonly known as 1099 contractors, has become increasingly prevalent. Small businesses, in particular, often rely on these freelancers for their specialized skills, flexibility, and cost-effectiveness. However, with this reliance comes the crucial responsibility of properly managing and handling these contractors to ensure legal…