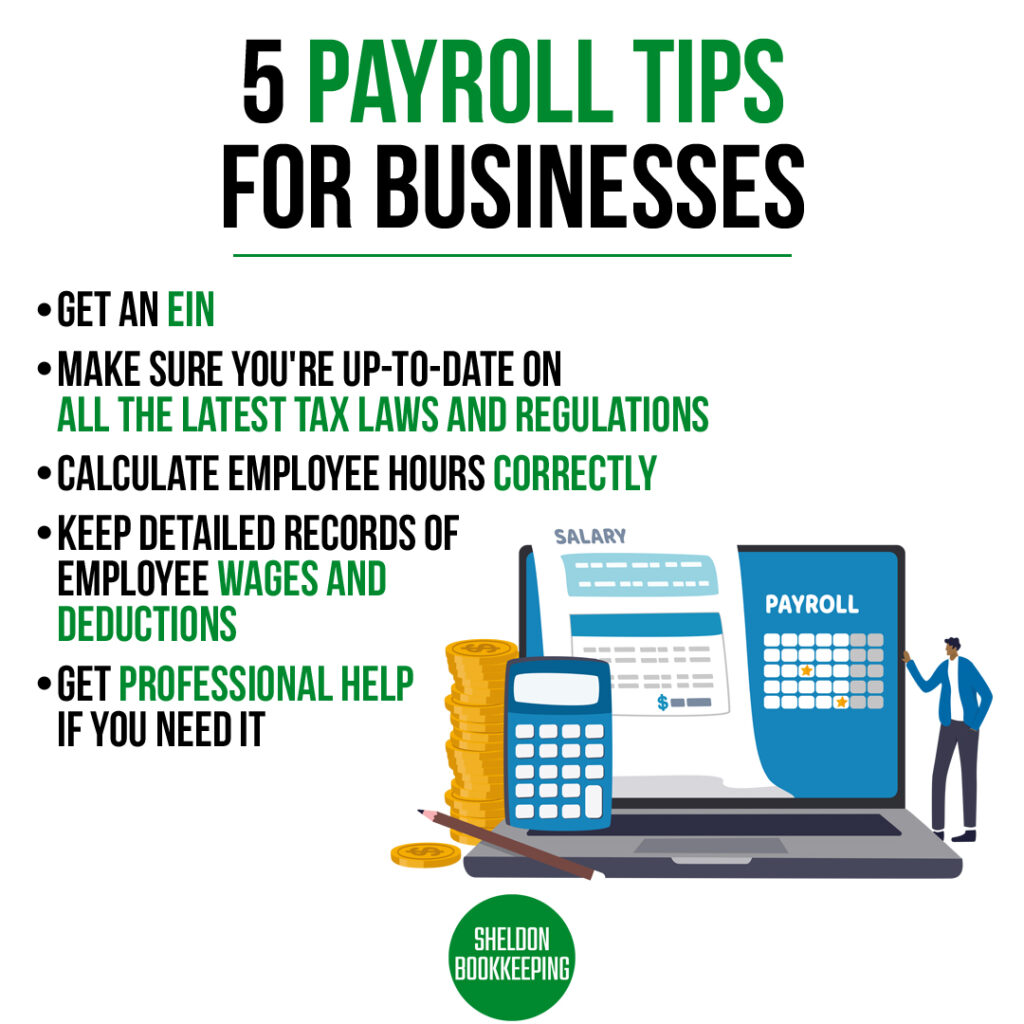

Payroll management is the heartbeat of any business, ensuring that employees are compensated accurately and on time. In today’s fast-paced world, leveraging efficient tools like QuickBooks Payroll can make all the difference. As a leading provider of modern accounting solutions, Sheldon Bookkeeping is here to share five indispensable tips for mastering QuickBooks Payroll:

1. Stay Organized from the Start

Organization is key to successful payroll management. Before diving into QuickBooks Payroll, take the time to organize your employee information, including tax withholding details, pay rates, and employee classifications. Sheldon Bookkeeping recommends creating a structured system for storing and updating this information regularly to ensure accuracy and compliance.

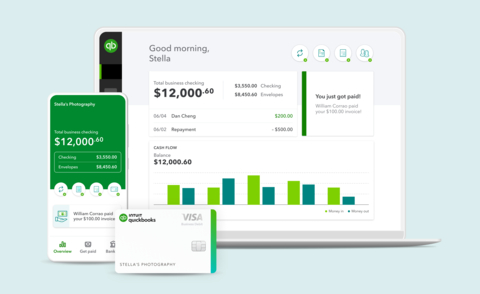

2. Utilize Automation Features

QuickBooks Payroll offers a plethora of automation features designed to streamline payroll processes and minimize errors. From automatic tax calculations to direct deposit options, take advantage of these features to save time and reduce manual data entry. Sheldon Bookkeeping suggests exploring the automation settings within QuickBooks Payroll and customizing them to fit your business needs.

3. Keep Up with Tax Compliance

Tax regulations are constantly evolving, making compliance a top priority for businesses of all sizes. Sheldon Bookkeeping advises staying informed about tax laws and regulations relevant to your business and ensuring that your QuickBooks Payroll settings are up to date. Regularly review and reconcile payroll reports to identify any discrepancies or potential compliance issues proactively.

4. Leverage Reporting Tools

Data-driven insights are invaluable when it comes to payroll management. QuickBooks Payroll offers robust reporting tools that allow you to track employee earnings, tax liabilities, and payroll expenses with ease. Sheldon Bookkeeping recommends regularly generating and reviewing payroll reports to identify trends, track expenses, and make informed financial decisions.

5. Seek Professional Support When Needed

While QuickBooks Payroll is designed to be user-friendly, navigating complex payroll issues can sometimes require expert guidance. Sheldon Bookkeeping emphasizes the importance of seeking professional support from experienced accountants or payroll specialists when faced with challenging payroll scenarios. Whether it’s addressing compliance concerns or optimizing payroll processes, don’t hesitate to reach out for assistance when needed.

Conclusion

Mastering QuickBooks Payroll is essential for businesses seeking to streamline payroll processes, ensure compliance, and optimize efficiency. By following these five tips from Sheldon Bookkeeping, you can harness the full potential of QuickBooks Payroll and take your payroll management to the next level. Remember, organization, automation, compliance, reporting, and professional support are the keys to success in payroll management.