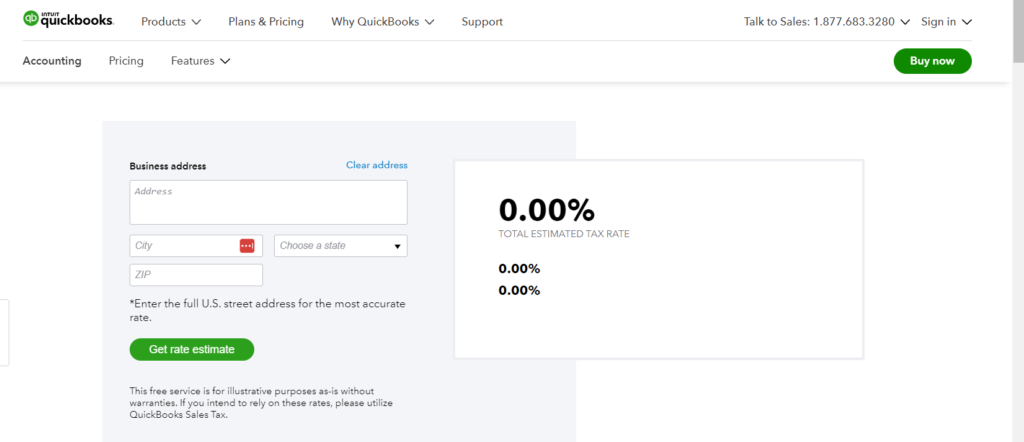

There is a FREE Sales Tax Caculator made available by Intuti QuickBooks. All you need to do is type in your business address, and it will display the rate.

Click here to open a new window to access the QuickBooks Sales Tax Calculator.

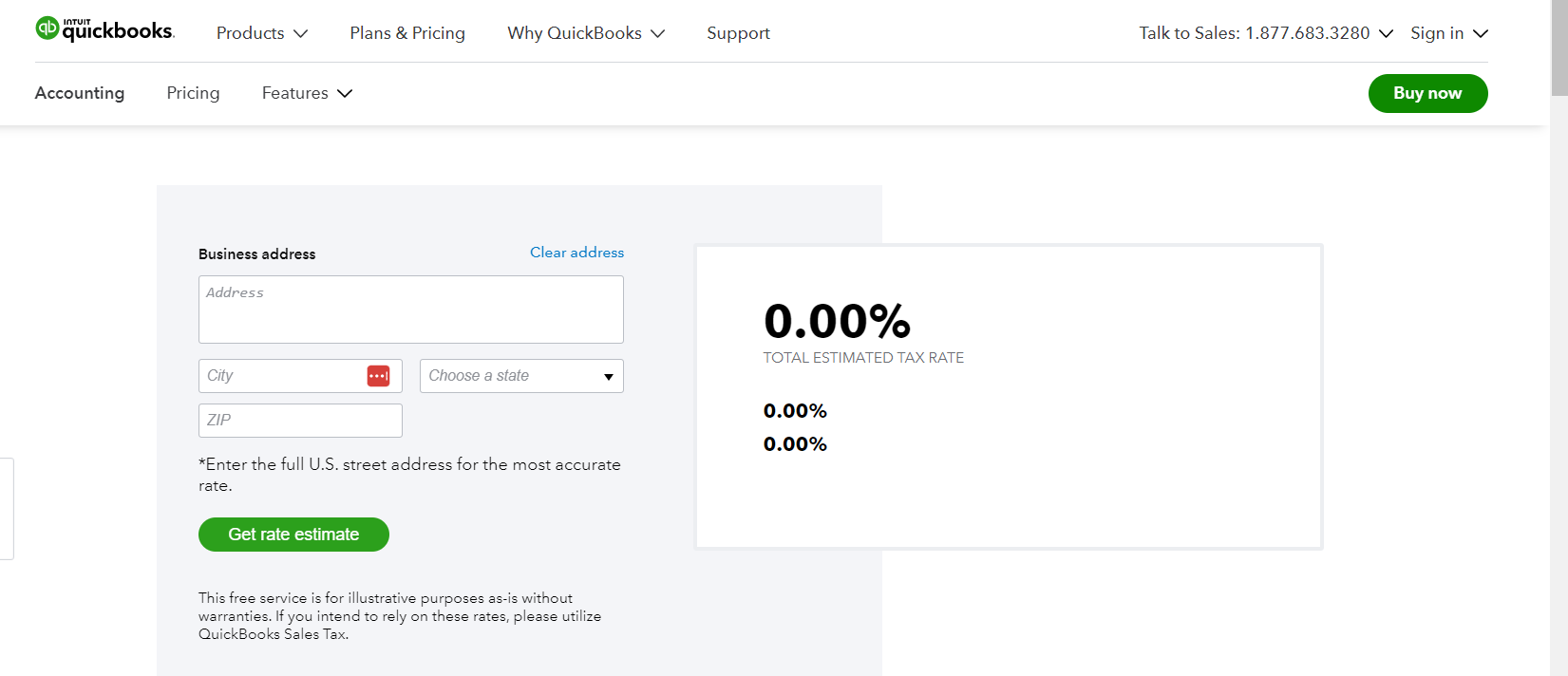

There is a FREE Sales Tax Caculator made available by Intuti QuickBooks. All you need to do is type in your business address, and it will display the rate.

Click here to open a new window to access the QuickBooks Sales Tax Calculator.

Facing a missed tax deadline can indeed induce stress, but there are constructive steps you can take to navigate this situation effectively. Let’s collaborate to reinstate your tax responsibilities and alleviate any concerns. Start by evaluating your tax status, pinpointing any overlooked filings or pending payments. Assemble all pertinent financial records such as income statements,…

Here comes QuickBooks Live Expert – set to launch on Monday, April 29. QuickBooks announced in an email, “There are two changes taking place on April 29th we wanted to make you aware of: There was a webinar yesterday about the new program. We were told that QuickBooks Live Expert will only provide coaching and no…

The IRS has a document entitled “Charitable Contributions” which can be downloaded from this website here. This publication explains what you are required to do as far as reporting contributions, and covers receipts that you are required to issue as a non-profit. The document is also linked in the footer area of this website.

Bookkeeping serves as the bedrock of financial management, providing businesses with a clear view of their fiscal health. From facilitating informed decision-making to ensuring compliance with tax regulations, accurate financial records are indispensable. In this article, we’ll explore some tried-and-tested best practices for bookkeeping, empowering businesses to maintain precision in their accounting processes. Keep Receipts:…

The QuickBooks Online Invoice is about to change. Here are some YouTube Videos that offer information about using the new invoice.

As of the latest guidelines, the IRS rules regarding the deductibility of meals and entertainment expenses as business expenditures have been shaped significantly by the Tax Cuts and Jobs Act (TCJA) of 2017 and subsequent clarifications. Here are the key points: Meals: Entertainment: Recordkeeping: Proper documentation is essential to substantiate meal and entertainment expenses. Businesses…