What it costs you to have a home office is a legitimate and deductible expense on your taxes. Many small businesses operate out of a home office – it’s quite vogue to do so.

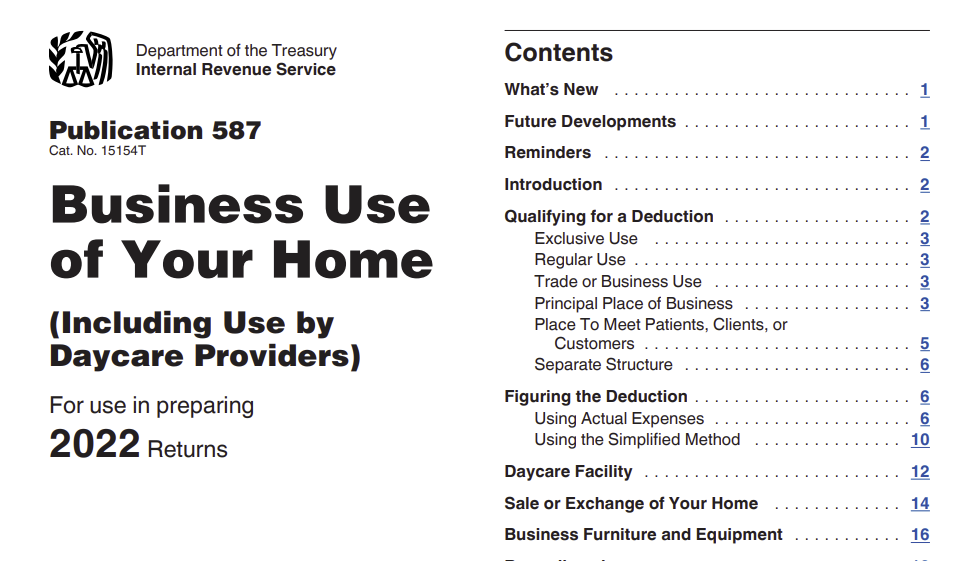

The IRS is not your enemy. They provide much free information about how you can take advantage of this deduction. To help you understand what you need to do, they have prepared a Publication that is not that difficult to understand. It is IRS Publication 587, Business Use of Your Home (and you can down load a copy here).

Two things will cause you problems:

Not maintaining accurate records.

From the Publication here is what the IRS says about recordkeeping:

You do not have to use a particular method of recordkeeping, but you must keep records that provide the information needed to figure your deductions for the business use of your home. You should keep canceled checks, receipts, and other evidence of expenses you paid..

Your records must show the following information.

- The part of your home you use for business.

- That you use part of your home exclusively and regularly for business as either your principal place of business or as the place where you meet or deal with clients or customers in the normal course of your business. However, see the earlier discussion, Exceptions to Exclusive Use under Qualifying for a Deduction.

- The depreciation and expenses for the business part.

You must keep your records for as long as they are important for any tax law. This is usually the later of the following dates.

- 3 years from the return due date or the date filed.

- 2 years after the tax was paid.

It is up to you to keep the records you need to prove your claim for the deduction. No records (and you could lose the deduction (and the lower amount you owe for your taxes).

Not following the IRS Rules

The IRS clearly states “Generally, you cannot deduct items related to your home, such as mortgage interest, real estate taxes, utilities, maintenance, rent, depreciation, or property insurance, as business expenses. However, you may be able to deduct expenses related to the business use of part of your home if you meet specific requirements.”

So what are those rules? Here we go:

Qualifying for a Home Office Deduction

To qualify to deduct expenses for business use of your home, you must use part of your home:

- Exclusively and regularly as your principal place of business;

- Exclusively and regularly as a place where you meet or deal with patients, clients, or customers in the normal course of your trade or business;

- In the case of a separate structure which is not attached to your home, in connection with your trade or business;

- On a regular basis for certain storage use;

- For rental use ; or

- As a daycare facility.

Exclusive Use

To qualify under the exclusive use test, you must use a specific area of your home only for your trade or business. The area used for business can be a room or other separately identifiable space. The space does not need to be marked off by a permanent partition.

You do not meet the requirements of the exclusive use test if you use the area in question both for business and for personal purposes.

Taxpayers generally get in trouble when they try to stretch the rules. Simply stated, don’t do that. If you don’t qualify, do not claim the deduction. A room used for personal and business does not meet the definition of exclusive business use.

Home Office Deduction and QuickBooks

QuickBooks is not designed to help you keep track of your expenses for the home office deduction. Only QuickBooks Self-Employed can do the claculation for you. QuickBooks Online does not. The rule is that we don’t mix personal with business transactions.

You should keep track of your home office deductions outside of QuickBooks, so the information is available at tax time.

Claiming the Home Office Deduction

Get started early. It is not time to start this during the rush at tax time. Set aside a little time each month to keep track of your expenses that are eligible for the deduction. Things like home insurance, Internet service, and utilities often qualify as part of the deduction. Download a copy of the actual IRS Form 8829 that is used to claim the deduction. You can quickly see those items that you should be tracking throughout the year.

Not only will deduction reduce your Federal Tax liability, but also like the state and local wage tax you must pay.