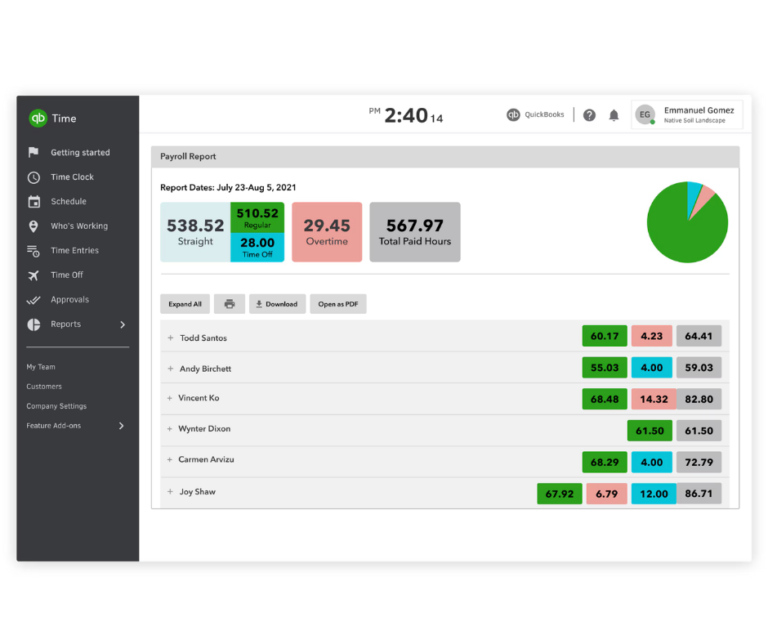

First on your list, it’s time to make sure all of your employees payroll information is up-to-date. The end of the year is often a busy time for many small businesses, so take care of verifying the employee information as soon as possible.

You should verify:

- Legal name

- Social Security number

- Current address

Errors in social security numbers is the number one issue that causes problems, and often requires refiling with corrected information.

Second, review what will be the last payday of the year. Make sure paid time off, bonus pay, and other benefits are accurate and taken care of. Planning ahead can prevent errors.

Third, if new benefits or changes are occurring in the new year, please make sure all documentation has been distributed and returned from employees. Avoid lapses in insurance coverage or other problems by getting everything done early. Create deadlines, and stick to them.

Another consideration is the bank holidays because Christmas and New Year’s Day. To ensure payroll is processed on time, consider running and making payment one day earlier to make sure the bank holidays will not impact your employees.