When setting up QuickBooks Online, in the Chart of Accounts, it is important to set up a special account to handle your Tenant’s Security Deposits. You can name the account anything (I recommend using Tenant Security Deposits.

The type of account is: other current liability. This is important. The reason a tenant’s security deposit is an other current liability account is that you are intending to return the deposit to the tenant at some point in the future. When the tenant moves out of your property, you will either return the deposit or you may use part (or all of it) to pay for rent that is due or damage to your rental unit.

On the practical side of the business, I suggest that you:

- Ask your tenant for two separate checks when renting your unit. One check is for the rent and the other check is for the security deposit. Make sure the tenant writes Security Deposit on the second check.

- Make two separate deposits into two separate bank accounts.

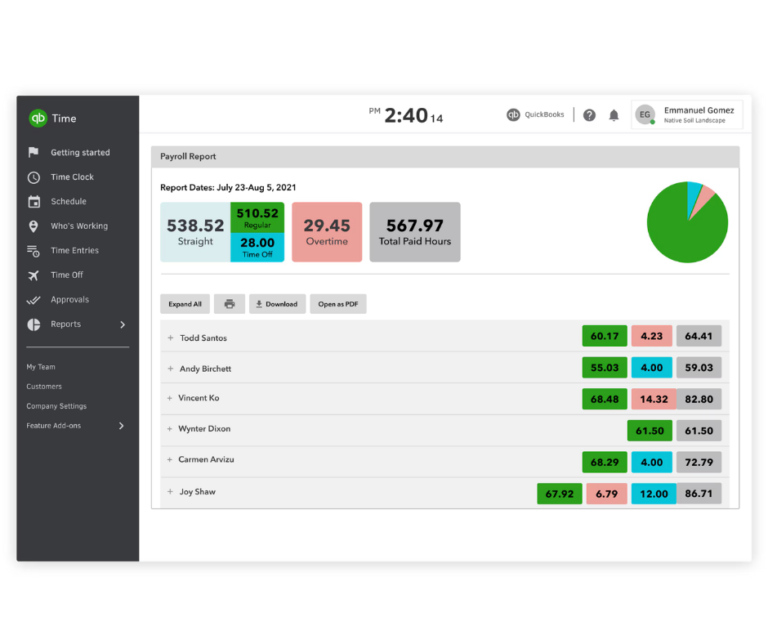

- Establish a separate bank account (typically a savings account) to keep your tenant security deposits. The bank account should be added to QuickBooks Online, and the amount in the savings account will balance against the other current liability account.

- I recommend that you keep a copy of the second check (the security deposit) as Tenants will often claim they gave the landlord a different amount as a security deposit.

Following this advice, your P&L Statement will balance insofar as the Tenant Security Deposit is concerned. You will always have the funds to return the security deposit, and you will have proof of what you received from the tenant.