Document Your Legitimate Business Expenses with Ease

In chatting with a local real estate investor – someone who flips properties and buys units for rentals- we talked about keeping receipts for tax time. The investor mentioned that he was sure he was losing track of some expenses because he misplaces the receipts.

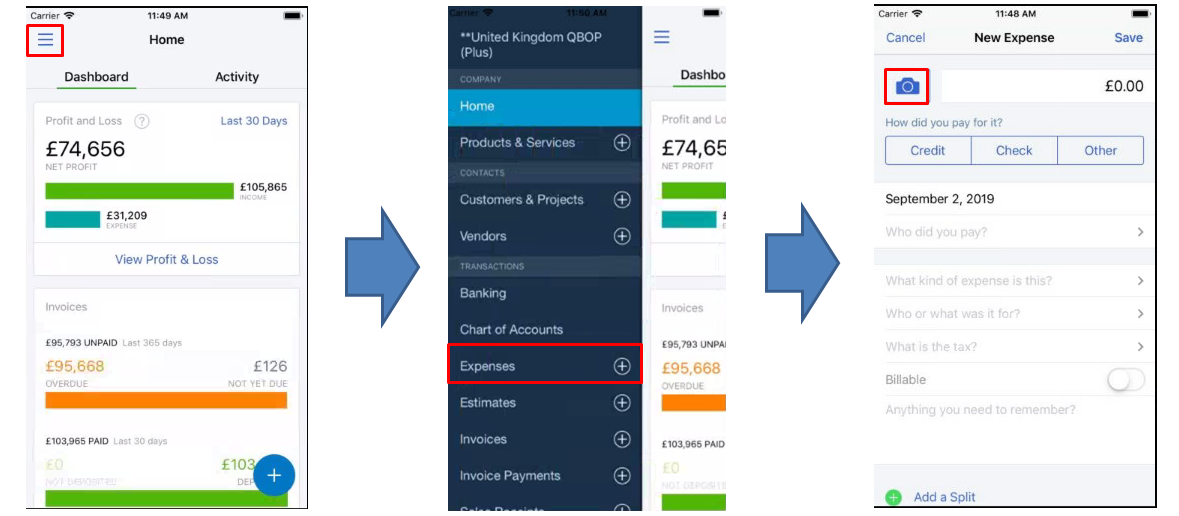

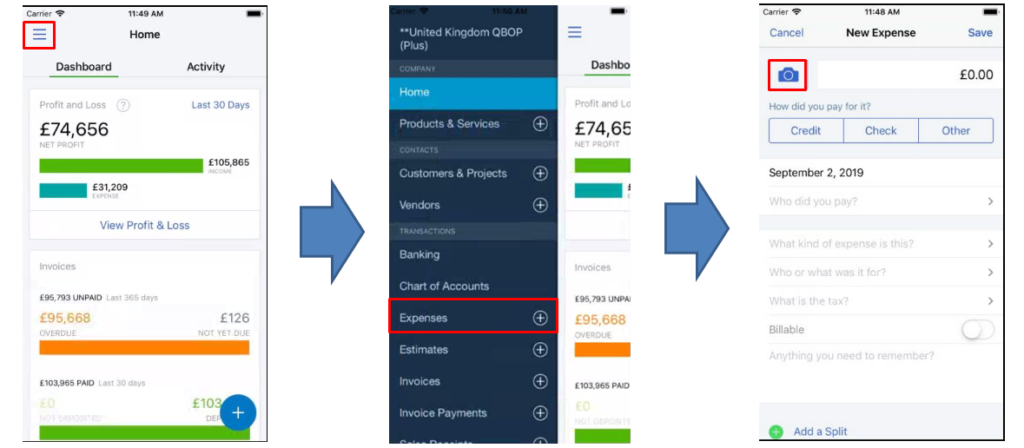

I told him about QuickBooks Online and the receipts capture app for his phone. I explained that we stopped at his local hardware store to get an extra set of keys, that $10 receipt could be easily added to his QuickBooks Online account by taking a picture of the receipt

That got his attention. He had recently purchased a new porch light for one of his rental properties and lost that receipt before it got filed away.

Of course, I told him the photo of the receipt would be stored in the cloud, always there if ever needed. Automatically backed up, too.

But what seemed to get his attention the most is when I answered his question about how much it costs to have the app and use the receipts capture app.

It’s included with your subscription, I told him. In other words, it is free to use.

You could have heard a pin drop.

You should be using the QuickBooks Online Receipts Capture, too. It is included in all QuickBooks Online plans. It is easy to add to your phone, and not difficult to add to your current QuickBooks company file.

I have been recommending this to all my real estate contacts, including agents, investors, and real estate managers.

You can learn more about the app by watching this video: