For small business owners, bookkeeping can often feel like a daunting task. However, it is crucial for the success of your business to keep accurate financial records. Here are some bookkeeping tips for small businesses that will help you keep your finances organized and make tax time less stressful.

- Keep Business and Personal Finances Separate

It’s important to keep your business and personal finances separate. This means having a separate bank account and credit card for your business expenses. This will make it easier to track your business expenses and income, and avoid any confusion when it comes to tax time. - Use Accounting Software

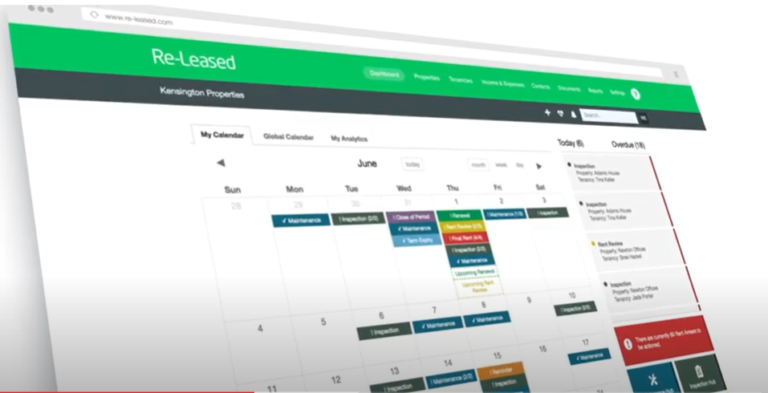

There are many accounting software options available that can help you manage your finances more efficiently. Some popular options include QuickBooks, Xero, and FreshBooks. These software programs can help you with invoicing, tracking expenses, and generating financial reports. - Keep Track of Receipts and Invoices

It’s essential to keep track of all your receipts and invoices. This will help you claim deductions and prepare your tax returns. You can use software or mobile apps to scan and store receipts, making it easier to organize and manage them. - Schedule Regular Bookkeeping Tasks

Set aside time each week or month to complete bookkeeping tasks. This could include reconciling bank and credit card statements, invoicing clients, and paying bills. By scheduling these tasks, you can stay on top of your finances and avoid any surprises. - Hire a Bookkeeper or Accountant

If bookkeeping is not your strong suit, consider hiring a bookkeeper or accountant. They can help you with tasks such as setting up accounting software, reconciling accounts, and preparing financial statements. Hiring a professional can save you time and ensure your finances are accurate. - Monitor Cash Flow

Cash flow is critical to the success of your business. It’s important to monitor your cash flow regularly to ensure that you have enough money to pay your bills and keep your business running. This can be done using accounting software or by creating a cash flow statement. - Plan for Taxes

Don’t wait until tax time to think about your taxes. Plan ahead and set aside money each month for tax payments. This will help you avoid any surprises and ensure that you have enough money to cover your tax bill.

In conclusion, bookkeeping is an essential part of running a small business. By keeping your finances organized and up-to-date, you can make informed decisions about your business and avoid any financial surprises. Use these tips to help you stay on top of your bookkeeping tasks and keep your business running smoothly.