QuickBooks Payments allows you to accept payments for your business and is a specifically convenient way to track all payments and accounting in one place for QuickBooks users. QuickBooks Payments accepts payments from Visa, Mastercard, American Express, and Discover, as well as ACH bank transfers and Apple Pay.

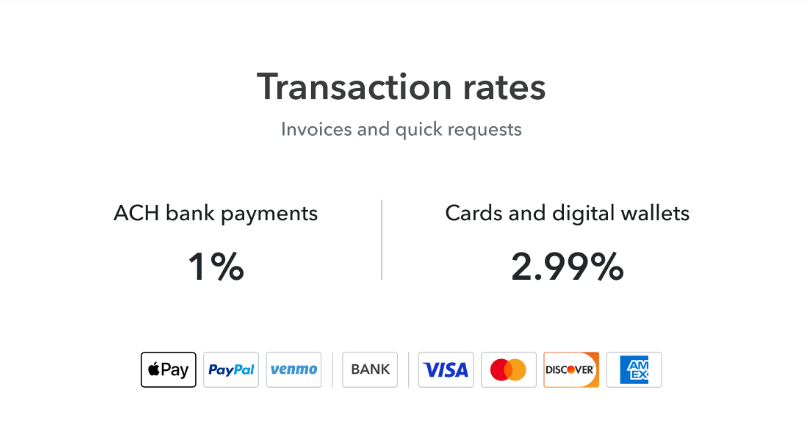

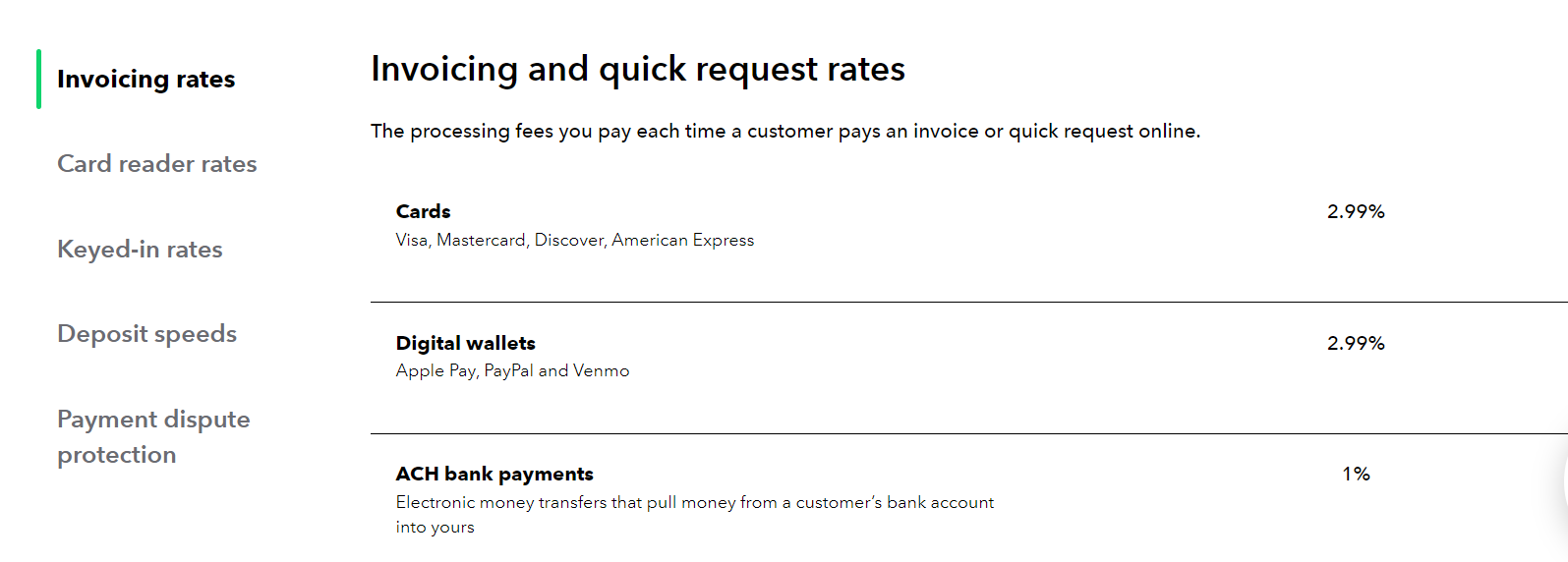

Invoicing Rates

With QuickBooks Payments, you can process ACH transactions, as well as accept and complete credit card processing. Rates are subject to change, but here are the current rates:

There are no monthly minimum transactions fees, and no per transaction fees. These types of accounts are often referred to as merchant accounts.

If your business accepts credit cards from your customer in person, or via website or other keyed in process, here are the current rates;

You can now send invoices to your customers through text messages with QuickBooks Online. This is an option with QuickBooks Payments, and it is in addition to regular email delivery. According to QuickBooks, “This helps create greater awareness of invoices and can make it easier for customers to pay them.”

Rates for keyed-in payments

The processing fees you pay when you manually enter a customer’s card information to process a payment are:

Cards: Visa, Mastercard, Discover, American Express 3.5%

Additional Information about QuickBooks Payments

(From Intuit’s Website)

QuickBooks Payments: QuickBooks Payments account subject to eligibility criteria, credit, and application approval. Subscription to QuickBooks Online required. Money movement services are provided by Intuit Payments Inc., licensed as a Money Transmitter by the New York State Department of Financial Services. For more information about Intuit Payments’ money transmission licenses, please visit https://www.intuit.com/legal/licenses/payment-licenses/.

You must have a QuickBooks Online account to use QuickBooks Payments. Deposits to you bank account is made on the next business day, unless you are using QuickBooks Banking, which offers same day availability of your deposit.