It’s time to get ready to issue 1099s. It’s one of those chores that need to be on your To Do list in January.

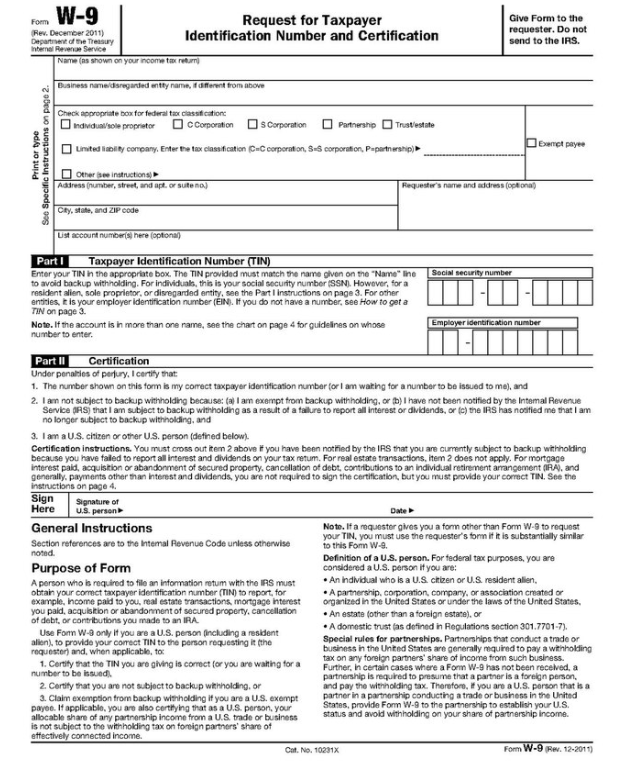

For my clients, I am making sure the W-9s are being updated this month. The Request for Taxpayer Identification Number and Certification should be used to get the information you need to create accurate 1099-NEC forms. Experience has taught me it is much easier to get W-9s returned in the month of December than it is in January.

Directly from the IRS.gov website, here is the information as to who you need to issue 1099:

File Form 1099-NEC for each person to whom you have paid during the year:

- At least $10 in royalties or broker payments in lieu of dividends or tax-exempt interest.

- At least $600 in:

- Rents.

- Prizes and awards.

- Other income payments.

- Medical and health care payments.

- Crop insurance proceeds.

- Cash payments for fish (or other aquatic life) you purchase from anyone engaged in the trade or business of catching fish.

- Generally, the cash is paid from a notional principal contract to an individual, partnership, or estate.

- Payments to an attorney.

- Any fishing boat proceeds.

In addition, use Form 1099-MISC to report that you made direct sales of at least $5,000 of consumer products to a buyer for resale anywhere other than a permanent retail establishment.

This information came from this IRS link.

If you are not using QuickBooks, you can download forms from the IRS website.

If you are using QuickBooks Online, it is easy to generate and deliver 1099s. After setup, QuickBooks Online will do the work for you.