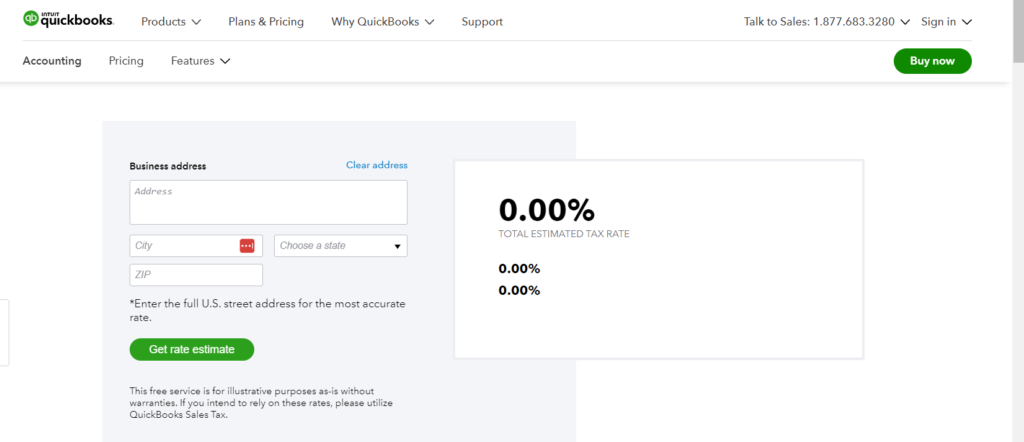

There is a FREE Sales Tax Caculator made available by Intuti QuickBooks. All you need to do is type in your business address, and it will display the rate.

Click here to open a new window to access the QuickBooks Sales Tax Calculator.

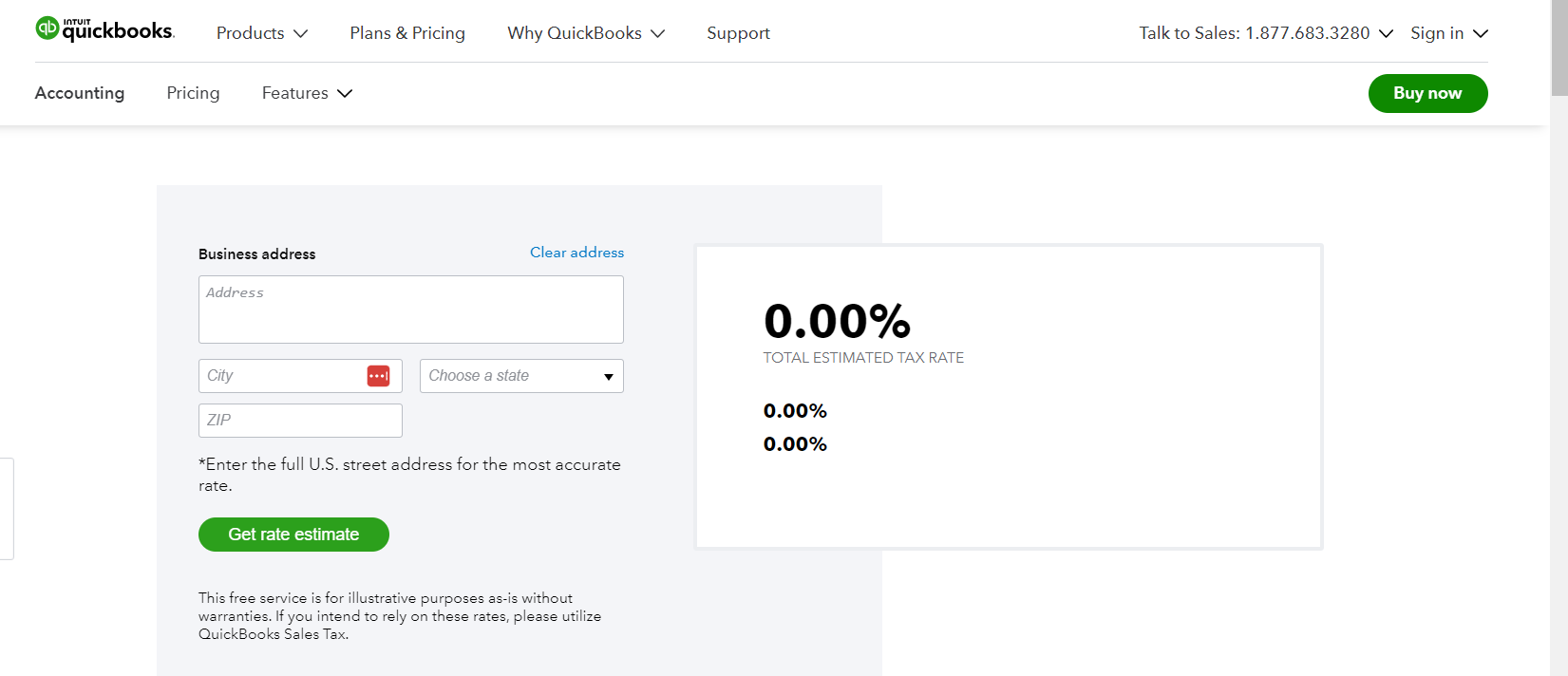

There is a FREE Sales Tax Caculator made available by Intuti QuickBooks. All you need to do is type in your business address, and it will display the rate.

Click here to open a new window to access the QuickBooks Sales Tax Calculator.

Intuit has expanded the availability of the QuickBooks Business Network to millions of small and mid-market businesses in the United States By doing so, Intui has created one of the largest business-to-business (B2B) networks that will accelerate and automate B2B payments. It will also improve cash flow. “With the QuickBooks Business Network, we’re innovating to…

Managing cash flow is vital for the success and sustainability of any business. Cash flow, the movement of cash in and out of a business, must be positive to ensure bills are paid, growth is financed, and solvency is maintained. This article outlines essential strategies for effective cash flow management and highlights common pitfalls to…

Streamline Your Business with Sheldon Bookkeeping’s QuickBooks Online Point of Sale Integration Introduction: In today’s fast-paced business environment, efficiency is key. To stay ahead of the competition, small businesses need to optimize their operations and streamline their processes. One crucial aspect of running a successful business is maintaining accurate financial records. This is where Sheldon…

Now available for free from Sheldon Bookkeeping: a Chart of Accounts for Real Estate Agents. This Chart (COA) is compatible with all versions of QuickBooks Online. It is for the smaller real estate agent business, as it does not include categories for employees. It does include accounts to categorize different sources of income as well…

Just a day after being notified that Sheldon Bookkeeping is a part of the QuickBooks Business Affiliates Program, we have received word that we reached Platinum status as a Certified QuickBooks ProAdvisor. “what a ride this has been!” And we are not done yet. We are planning to continue our work as a real estate…

QuickBooks Enterprise stands as the most advanced QuickBooks product, offering a comprehensive end-to-end software solution that integrates inventory management, payroll, and sales tracking. As of June 7, 2024, the pricing for QuickBooks Online Enterprise on Intuit’s website is as follows: Each subscription level includes enhanced payroll, with higher tiers providing additional features such as inventory…