QuickBooks Self-Employed is designed to help you record your self-employed income and expenses, track your mileage, and prepare your Schedule C.

SPECIAL NOTICE:

On February 22, 2024, QuickBooks announced the release of Solopreneur. With the announcement, Self Employed will not be available to new subscribers. Current subscribers will be allowed to review. Please visit our blog post for more information QuickBooks Online Solopreneur. We will be adding Solopreneur to our supported QuickBooks Online products as soon as it is available to us.

You can access your QuickBooks Self-Employed from a web browser or the mobile app. Your data will syncs in both places. The mobile app is better for tasks on the go, like tracking mileage.

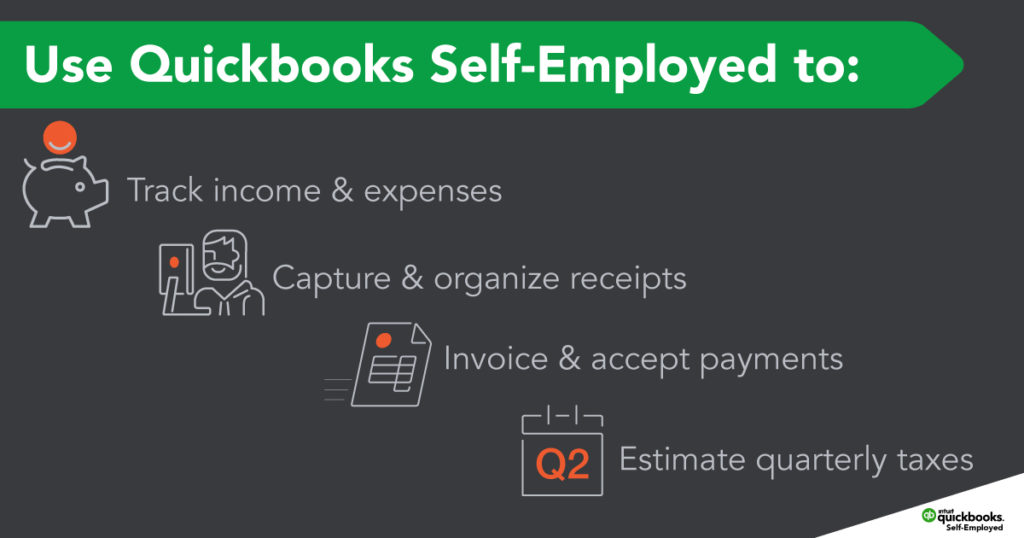

Here are the main features of QuickBooks Self-Employed:

- Track and organize your business income and expenses.

- Maximize your business deductions.

- Enter data quickly with online banking.

- Track your business mileage and claim mileage deductions.

- Run reports to figure out your business profit.

- Calculate your estimated federal quarterly tax payments.

- Put your expenses into the correct Schedule C categories.

- Send your data to TurboTax Self-Employed for fast year-end filing.

Click for special offer from our affiliate link.

QuickBooks Self-Employed is specifically designed for

freelancers, independent contractors, and small business

owners who need an easy-to-use bookkeeping tool.

Save money on your taxes. Spend more time on your business.

Getting Started with QuickBooks Self-Employed has never been easier.

.Take control of your business. Know your numbers. Be ready at tax time.

See QuickBooks Self-Employed in Action

Watch this YouTube vide to see how QuickBooks Self-Employed works, and how you can send the data in your file to TurboTax.