The Sheldon Bookkeeping website will be getting a bit of a face list over the next week. Plans include some changes in the page structure, and hopefully, making the website a bit easier to use. The makeover should be completed by January 31.

Similar Posts

QuickBooks Online for Landlords: How to Handle Tenant Security Deposits

When setting up QuickBooks Online, in the Chart of Accounts, it is important to set up a special account to handle your Tenant’s Security Deposits. You can name the account anything (I recommend using Tenant Security Deposits. The type of account is: other current liability. This is important. The reason a tenant’s security deposit is…

Could the Housing Market Slowdown impact your business in 2023?

A published article by USA Today titled “Housing market: Pending home sales plunge for fourth straight month” reports the slowdown of the housing market. This news could impact real estate sales, contractors, firms that do remodeling services, lenders, and others associated with the industry. Start planning now for business changes next year. If you haven’t…

IRS 2023 Mileage Rates Announced

New Rates for 2023 Released The Internal Revenue Service Service has announced the new 2023 mileage rates. The optional 2023 standard mileage rate for business, medical, and other uses of an automobile is 65.5 cents per mile. This is a 3-cent increase from the 62.5-cent rate that was set during the second half of 2022….

QuickBooks Online Automates Rent Collection for Landlords

Using a QuickBooks Online feature called recurring sales receipts, landlords can easily set up and automate rent collection via credit cards or ACH. Once it is set up in QuickBooks Online, each month the tenant is automatically charged the rent payment. The tenant receives an email message and receipt for the rent payment. And the…

Corporate Transparency Act – What Small LLC Businesses Need to Know

Introduction to CTA In a world where financial transactions and business dealings are increasingly complicated, transparency and accountability have become vital. The Corporate Transparency Act (CTA), signed into law in December 2020 as part of the National Defense Authorization Act (NDAA), represents a considerable step forward in promoting openness in corporate ownership. This groundbreaking legislation…

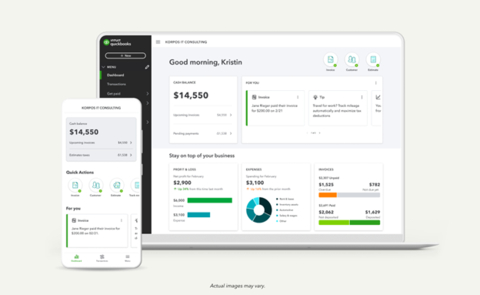

QuickBooks Announces Solopreneur – A New Subscription for Self Employed

Solopreneurs for the One Person Business QuickBooks has announced a new subscription for QuickBooks Online. It is called Solopreneur. “Solopreneur is designed to help one-person businesses quickly and easily simplify their business finances,” QuickBooks says. . The new subscription offers these features: Solopreneur Monthly Subscription Cost The QuickBooks Solopreneur Subscription is available at $20 per…