For real estate investors, properly filing Form 8825—the IRS document used to report rental income and expenses—is essential for staying compliant and optimizing tax benefits. Yet, navigating the complexities of rental property bookkeeping can be daunting without expert guidance. That’s where Sheldon Bookkeeping comes in, ensuring accuracy, efficiency, and maximized deductions for investors.

Understanding Form 8825

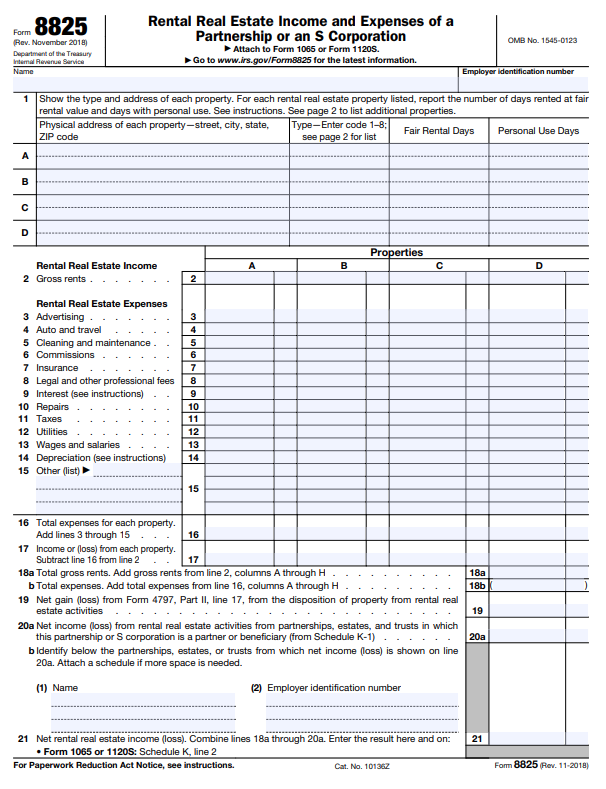

Form 8825 is a critical component for partnerships and S corporations reporting rental real estate activity. Unlike Schedule E (used by individuals), this form allows multiple owners to document income, expenses, and depreciation associated with their properties. Errors in reporting can lead to audits or missed tax benefits, making precise bookkeeping a necessity.

You can download a copy of the IRS Form 8825 by clicking here (a new tab will open).

How Sheldon Bookkeeping Optimizes 8825 Reporting

At Sheldon Bookkeeping, we specialize in real estate accounting, leveraging QuickBooks Online to streamline financial tracking and ensure each transaction is accurately recorded. Here’s how we help:

✔ Detailed Expense Categorization – We properly classify expenses like mortgage interest, property repairs, insurance, and utilities, ensuring compliance with IRS guidelines.

✔ Accurate Income Tracking – Rental income is recorded systematically, making reconciliation seamless and tax filings effortless.

✔ Depreciation Calculations – Investors often overlook depreciation benefits; we ensure assets are reported correctly for optimal deductions.

✔ Error-Free Recordkeeping – Avoid costly mistakes with precise data entry, reconciliations, and regular financial reviews.

Optimized Chart of Accounts for Real Estate Investors

A well-structured Chart of Accounts is essential for accurate tax reporting, streamlined recordkeeping, and optimized financial tracking for rental property businesses. Below is a fine-tuned setup designed specifically for real estate investors using QuickBooks Online.

| Category | Account Name | Purpose |

|---|---|---|

| Assets | Rental Properties | Tracks the cost and value of owned properties. |

| Accumulated Depreciation | Records property depreciation deductions. | |

| Security Deposits Held | Liability for deposits owed to tenants. | |

| Liabilities | Mortgage Payable | Tracks outstanding loan balances. |

| Property Taxes Payable | Records taxes due to the government. | |

| Equity | Owner’s Equity | Tracks contributions and withdrawals. |

| Income | Rental Income | Records rent received from tenants. |

| Late Fees & Penalties | Tracks additional tenant charges. | |

| Expenses | Mortgage Interest | Deductible interest on property loans. |

| Property Management Fees | Costs paid for third-party management. | |

| Repairs & Maintenance | Non-capitalized maintenance and repairs. | |

| Depreciation Expense | Annual depreciation deductions. | |

| Utilities | Water, electricity, gas, and other tenant-paid utilities. | |

| Insurance | Property and liability insurance costs. | |

| Advertising & Marketing | Expenses for listing vacancies. | |

| HOA Fees | Homeowners association dues for managed properties. | |

| Other Income | Lease Termination Fees | Income from early lease terminations. |

| Other Expenses | Professional Services | Legal, tax, and bookkeeping expenses. |

This customized chart ensures precise IRS compliance, making Form 8825 filings seamless for rental property owners and partnerships.

The QuickBooks Advantage for Real Estate Investors

Using QuickBooks Online, Sheldon Bookkeeping provides real-time financial insights and customized reports tailored to real estate businesses. Investors benefit from:

📊 Automated rental property tracking for accurate monthly reporting.

💰 Instant financial visibility, so investors make informed decisions.

✅ Seamless integration with tax preparers to ensure smooth filings.

Ensure IRS Compliance & Maximize Deductions

With Sheldon Bookkeeping’s expertise, real estate investors can confidently file Form 8825, maximize deductions, and focus on growing their portfolios, not getting lost in the numbers.

📞 Ready to optimize your rental property bookkeeping? Contact Sheldon Bookkeeping today!

Leave a Reply